STATE OF THE MARKET ⚡️

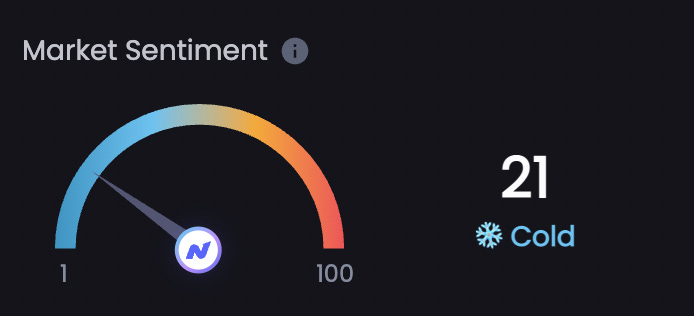

It’s nice to see the overall sentiment and feeling towards the NFT market pick up over the last week or so.

It would still appear we are still pretty cold though considering just a few weeks ago the overall sentiment had a score of ‘8’ yes… ‘8’. We will take ‘21’ as a positive movement. In essence, the overall NFT population feels twice as good about the market… LFG!

Floors have been on the rise for certain projects, demonstrating that even in a choppy market major pumps and bullish movements are still live. One project in particular that we covered a few weeks back has stolen the show this week is Digidaigaku. If you recall, the project’s Floor Price mooned on the announcement that its parent company Limitbreak had received $200M in funding to build a web3 games. On September 15th the Digidaigaku genesis floor dumped down to as low as 6ETH and at the time of writing today the Floor has rocketed back up to 13.69ETH. On top of that earlier this month, holders of Digidaigaku were airdropped a ‘Digidaigaku Spirit’ which now has a Floor price of around 6ETH. Talk about an ROI.

As of tomorrow holders of Digidaigaku spirits as seen above will be able to burn them in order to receive a Digidaigaku Hero.

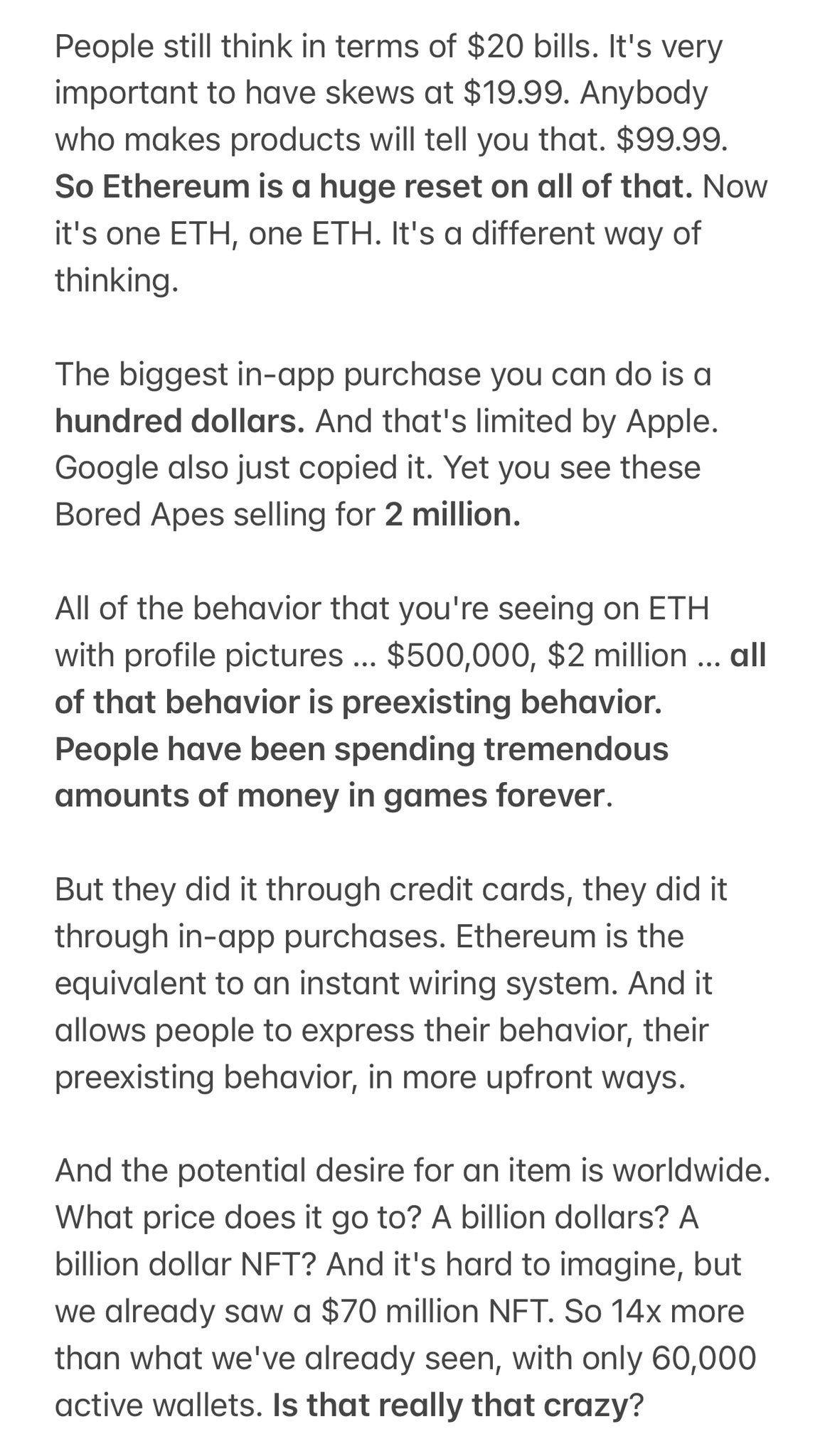

The Founder Gabriel Leydon has gained a serious following over the last few weeks on Twitter and absolutely loves posting memes that speak to web3 culture. More importantly, he recently predicted how one day soon we could see a $1Billion priced single NFT. Below is an extract of a recent podcast he did that shares his ideas as to why & how that could happen.

As far as the crypto markets go, ETH has pulled back following the Merge which was to be expected given the macro environment. ETH now sits at a price of $1333

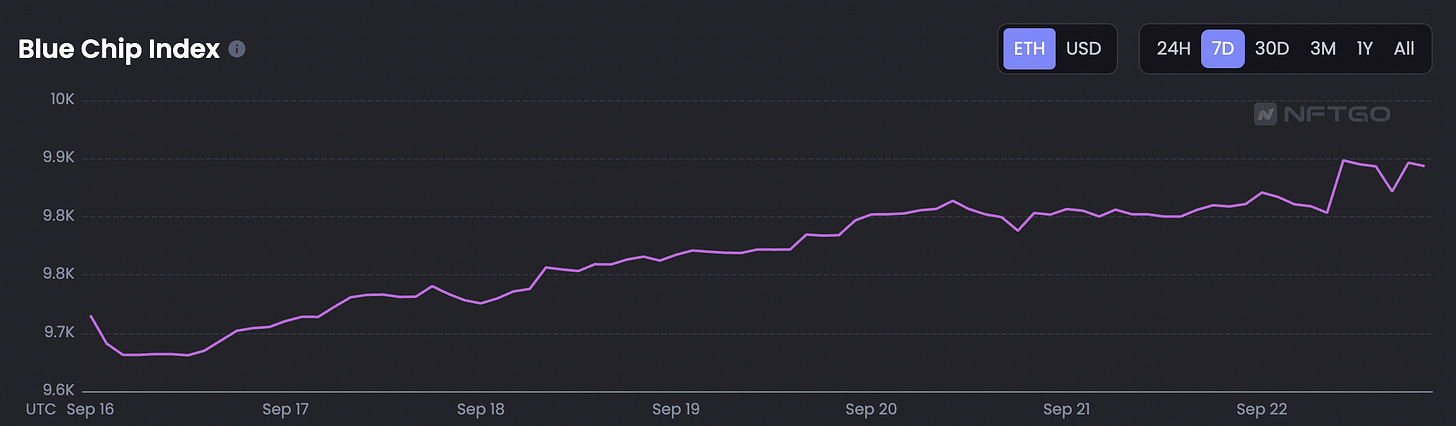

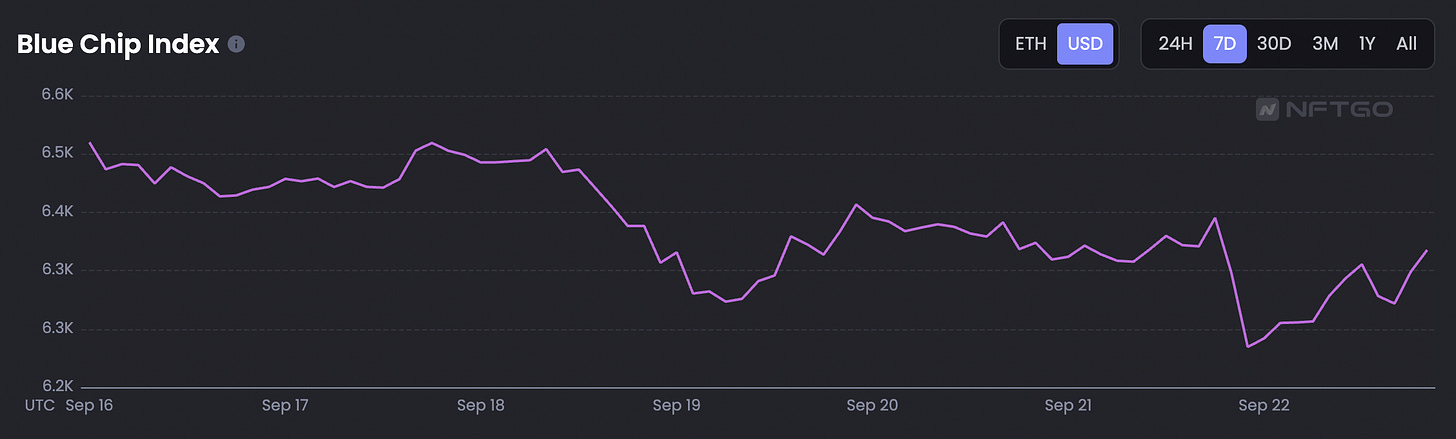

With ETH pulling back in $ value with further down trends to be expected, this will likely reprice a number of Bluechips when pricing it in dollar value. As we can see from the blue-chip index in ETH terms it has risen slightly over the past 7 days, but in terms of $ value, it has trended downwards. If ETH continues to tumble following the merge hype and macro conditions, expect opportunities to scoop up some blue chips NFTs at a bargain price.

Scoops of the Week 🍦

🍦Opensea introduces subtle changes

🍦TravelX Platform Launches NFTickets

🍦New York Office NFT Purchase

🍦White Hat Hacker Rewarded

🍦Funko Partners with Warner Brothers

🍦TravelX Platform Launches NFTickets

NFTs that make you fly? Yes please.. But how??

TravelX, a marketplace for tokenized travel products, went live on Wednesday with the offering of inventory of the low-cost Argentine airline Flybondi.

The platform currently offers 2.5 million tickets, the tickets are then tokenized and when they are purchased are then converted into NFTs, which are called NFTickets.

Following the purchase of an NFTicket, customers will then be able to auction, sell, transfer, gift or exchange them through a peer-to-peer system on TravelX.

Users will be able to fund the Travelx wallet which will also manage the NFTickets, You will also have the option to pay via BinancePay.

To purchase tickets on the platform, users can fund the TravelX wallet — which also serves to manage the NFTickets — or pay via BinancePay. Diaz added that the company is in talks to integrate other exchanges.

TravelX is built on the Algorand blockchain and made its infrastructure open so that other companies — such as exchanges or marketplaces — can use TravelX's APIs to create their own marketplaces.

Within six to 12 months, the platform hopes to incorporate the inventory of more than 60 airlines, with a special focus on Latin American and European operators. In 2023, the company will focus more on the U.S. and Middle East.

In November, the company closed a $11 million seed round led by Borderless Capital, said Diaz, who added that it plans to raise a Series A funding round early 2023. The company has 85 employees.

Opensea introduces subtle changes

Normally when Opensea hit the headlines it’s usually for negative reasons as opposed to positive ones.

Well, the latest update that has hit the website is a bit of a positive (we think so anyway)

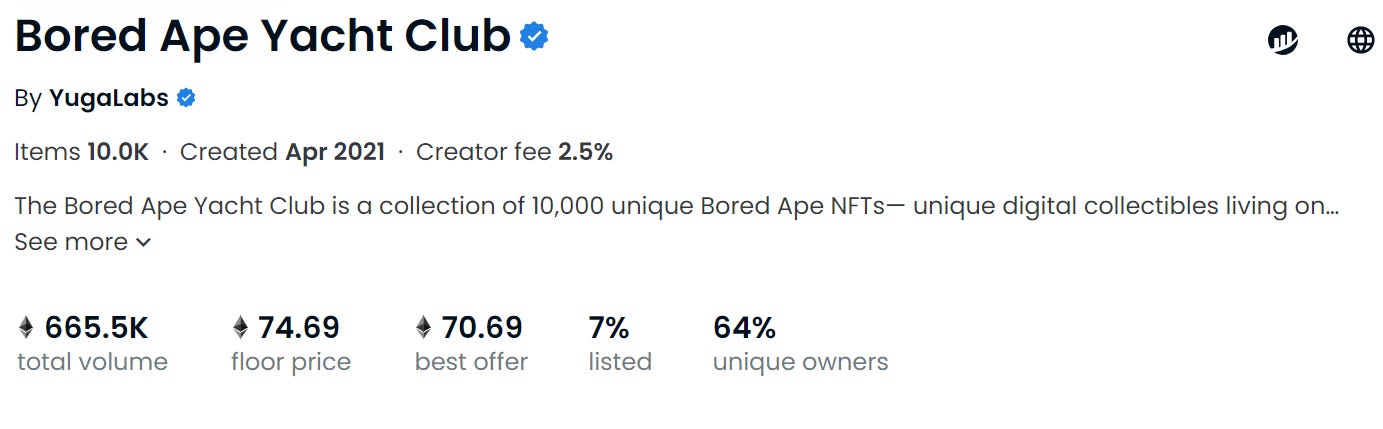

The new cover of each project states Creator Fee, % of Collection Listed, and % of Unique Owners.

Of course, this is not the sniping tool of the century however for newer people entering our world this could prove to be a useful tool. This also isn’t just limited to newer people, if you wanted to have a general gist of the project this new information provided on the face without searching comes in handy for the following reasons.

% Of Collection listed - You can form an immediate opinion of the bullishness of the project, you can determine if it’s a quick flip or even if the project is about to break through a sell wall.

% Of Unique Owners - You can identify if the project is involved in potential wash trading also if the project has a high spread of the distribution, this will aid in protecting smaller holders from erratic floor price changes due to a large holder dumping their NFTs.

New York Office NFT Purchase

Just to remove any ambiguity yes, an NFT has been purchased regarding a New York office however this purchase is strictly NFT only and does not come with physical keys to any office.

What is significant about this purchase however is that this NFT is the first ever NFT office building sold in New York City.

The 16 Story NFT sold for 1 ETH and was created by spatial intelligence company Integrated Projects and questions the function of architecture in Real Estate and the Metaverse.

White Hat Hacker Rewarded

There’s an old rumor that has gone around the block many times that is as follows:

If you hack the Government, you either end up on the payroll or in a cell.

Well in Web 3 what happens if you are a white-hat hacker and detect a critical $400m vulnerability?

Arbitrum has the answer!

They rewarded white-hat hacker @0xriptide with 400 ETH after detecting a critical $400M vulnerability.

We are unsure what this vulnerability was, however, if any of our readers out there are in any way skilled in this field, make sure you put them to good and proper use, and out there lies a handsome reward.

Funko Partners with Warner Brothers

Funko has partnered with Warner Brothers for an upcoming DC Comics’ NFT Release.

The 30k collection known as “Brave and the Bold” will be sold on Walmart’s website at Walmart Collector Con from 7th October 2022.

The physical/digital project will be a combination of physical and digital comic book collectibles meaning “The Brave and the Bold” available both in printed form and as an NFT.

Sometimes NFTs don’t have to be investments, some can certainly be a nostalgia purchase or one that is just for personal pleasure. We feel this parentship ticks that box.

Scoop’s Weekly Winner 🏆

This project has been in the headlines before for both good reasons and bad.

From the highs of blue-chip potential to the lows of the founder admitting to being part of 3 previous rugged projects causing the floor price to nose-dive.

Well, this time it’s back in the Newsletter for positive reasons and is taking home this week’s winner status.

Azuki…welcome back to the Newsletter.

As always, the rumor mill causes action, and in Azuki’s case, there has certainly been action.

It’s being reported that the project is set to welcome $30m of fundraising.

The result of this has sent the floor rocketing from 7.5 ETH to 11.7 ETH

This follows the recent fundraising brought in by blue-chip Doodles which you will remember our report on.

REKT SECTION 😡

When 140 people come forward stating their invested money has vanished, alarm bells start ringing.

Unfortunately, in this instance, answers aren’t immediately present, but action has already been taken.

Aiden Pleterski “King of Crypto” …Welcome to REKT.

The “King of Crypto” and his company AP Private Equity Limited are set to face a minimum of two civil lawsuits after 140 investors have said they invested a combined $35 million with him.

The 23-year-old has had his vehicle collection which includes BMWs, McLarens, and a Lamborghini seized since the allegations were made.