Market Activity

As the above market chart shows, it was a bullish week in the NFT space with high volume, increasing floors and delisting’s as more investors switch to holding instead of flipping. There were a few standout winners of the week as well as some losers.

Weekly Winners

CryptoSkulls saw a 385% floor increase over the last seven days tied with a volume increase of 301%. On January 14th the floor sat at just 0.4eth climbing to a peak of 4.7eth in just 24 hours. The price then bottomed off at 2eth, consolidated, and at the time of writing is pushing above 3eth. The sudden pump in CryptoSkulls volume and floor lies in the hands of Gary Vaynerchuck. After significant murmuring behind the scenes that Skulls were one of the original profile picture NFT’s, Gary invested 100eth into a Skull and then hosted a Twitter Spaces explaining his decision to an engaged audience.

Following the Twitter Spaces, there was a huge surge in price led by fomo. Whilst Skulls may prove to be a solid long-term investment, it is vital to remember a huge surge driven by fomo and influencers is not sustainable and a significant fall off can be expected. It is also up for debate whether Skulls is the first profile picture project and whether the project can be successful with a team that failed to deliver on their roadmap from 2019-2021.

The week saw a large increase in volume for Women in NFT’s related projects. This charge was led solely by World of Women. WOW saw a 116% increase in floor and a volume increase of 137%. From January 12th to January 15th the floor price increased from 3.6eth to a peak of 9.3eth. At the time of writing the price is currently consolidating in the 8eth region. The initial pump was created by Guy Oseary who is Madonna’s manager and tech investor signing WOW to his collective for representation. WOW will now be joining BAYC, Madonna, U2 and Red-Hot Chilli Peppers. Despite such a big pump it is clear that World of Women is here to stay and is cementing itself as a blue-chip. As such, the future looks extremely bright for WOW both short and long term.

Weekly Losers

After an extreme Asian fuelled pump, the Phanta Bear floor grew from .3eth to 8.5eth in a week. The project found itself pumping due to the influence of founder, Jay Chou, a popstar in the region. Once Western investors caught wind of this pump, they fomo’d in. However, as the price suggests many were left holding the bags of the ‘Asian BAYC’. Volume took a 70% tumble this week while the floor dipped 41%.

At the time of writing the floor is 3.14eth. While Phanta Bear may be a long-term success due to being the first project to really tap into the Asian market, it is likely many Western retail investors will continue to sell off and the floor will consolidate or dip further.

Desperate Ape Wives was one of the first projects to pump heavily. However, this occurred before the bull market as a result of a successful Miami Art Basel for the project. This premature climb has led to a rocky few weeks for the project and specifically, a significant dip this week. This week volume has decreased a further 20% and floor has fallen a further 30%. Negative price action was not helped by scandal last week when the project’s art was accused of being ‘racist’ in a popular Twitter Spaces. However, DAW saw price correlation close to BAYC and was one of the first popular BAYC derivatives. The team on the project are extremely talented, marketing is strong and the project will likely be a success in the long-term. In the short-term further consolidation is to be expected before possibly breaking out depending on BAYC news and hype.

Picks of the Week

Blue-Chip Picks:

With rumours of featuring heavily in the Superbowl next month it is to be expected that the BAYC ecosystem will continue it’s run up. When BAYC moves, the market moves with it, and with a bullish NFT market it would be obscene to assume that further positive price action isn’t to be expected over the coming weeks. Especially as the number of Apes being delisted increases by the day.

Mid-Chip Picks:

After a large rise to 1.8eth, Coolmans has been consolidating on the 1eth range for a few days. With 15% of the supply listed and an average of 137 items delisted over the last seven days it can be expected that Coolmans may see another breakout in the short-term.

After a successful launch avoiding any sort of post reveal dip Fomo Mofos looks like a good pick for the next week. Price has increased from 0.4eth to 0.7eth over the last two days and volume is flying into the project. While a dip followed by a consolidation phase can be expected the floor looks like it’s still got a while to run.

Low-Cap Gems:

After a call from a famous NFT influencer, 8sian minted out in under 30 minutes. The project was driven by both the Asian market hype and Women related project hype. While the price is now consolidating at .33eth a further pump may be expected over the coming week if Asian and Western influencers buy into the project.

The very first decentralised media platform did extremely well in its pre-reveal phase. Due to high supply, a post-reveal dip has occurred and will continue for the next few days. However, some major influencers are heavily invested in this one and short- and long-term positive price action can be expected.

Weekly Alpha

Weather Report has gained extreme traction over the last week since their launch announcement. The discord opened Monday 17th January and In less than 24 hours 23,000 people have joined and the engagement in the chat is relentless. Twitter followers currently stand at around 31,000. The known details on the project thus far are that the collection will be 10,000 and that the team is a powerhouse of 3 well known individuals in the NFT space. ZachGoesHard is the creative director, Will Nichols will be advising on the art side of things and Toby Lasso is expected to head up the business aspect of the project. While how to secure a whitelist is currently unknown owning ‘Letters’ by Vinnie Hager or Will Nichols ‘100 Palms’ (WN Visions also included) will grant you an automatic WL. However, despite this positive report. The illustrator of the project, Dentin, has broke ties with the team and took the art with him over a contract dispute. While this is likely to just be a small bump in the road, it may have a bad impact on the project and is something to keep your eyes on.

Socials:

Collider established itself on the NFT gaming scene a few weeks ago and has seen rapid growth since. The project has amassed 32,000 Twitter followers and the discord is locked. The project derives from a game studio in Argentina. The team is fully doxxed and is building an AAA quality game which will sell its avatars as NFT’s. While no details have been released on supply or release date yet, what is known is how powerful the team are.

The project has 84 individuals working on the game who have vast experience working previously on AAA titles such as Injustice 2, Street Fighter V, Assassin’s Creed, Gotham Knights and Mortal Kombat 11. Whitelisting on Collider is by no means easy. Firstly, there is the hurdle of getting into the locked discord by solving riddles on their twitter. The team handpick 20 people in the discord per day for WL by considering activity, positivity, helpfulness, art and so forth.

Discord = Locked (Access via Twitter Competitions)

Projects to Avoid

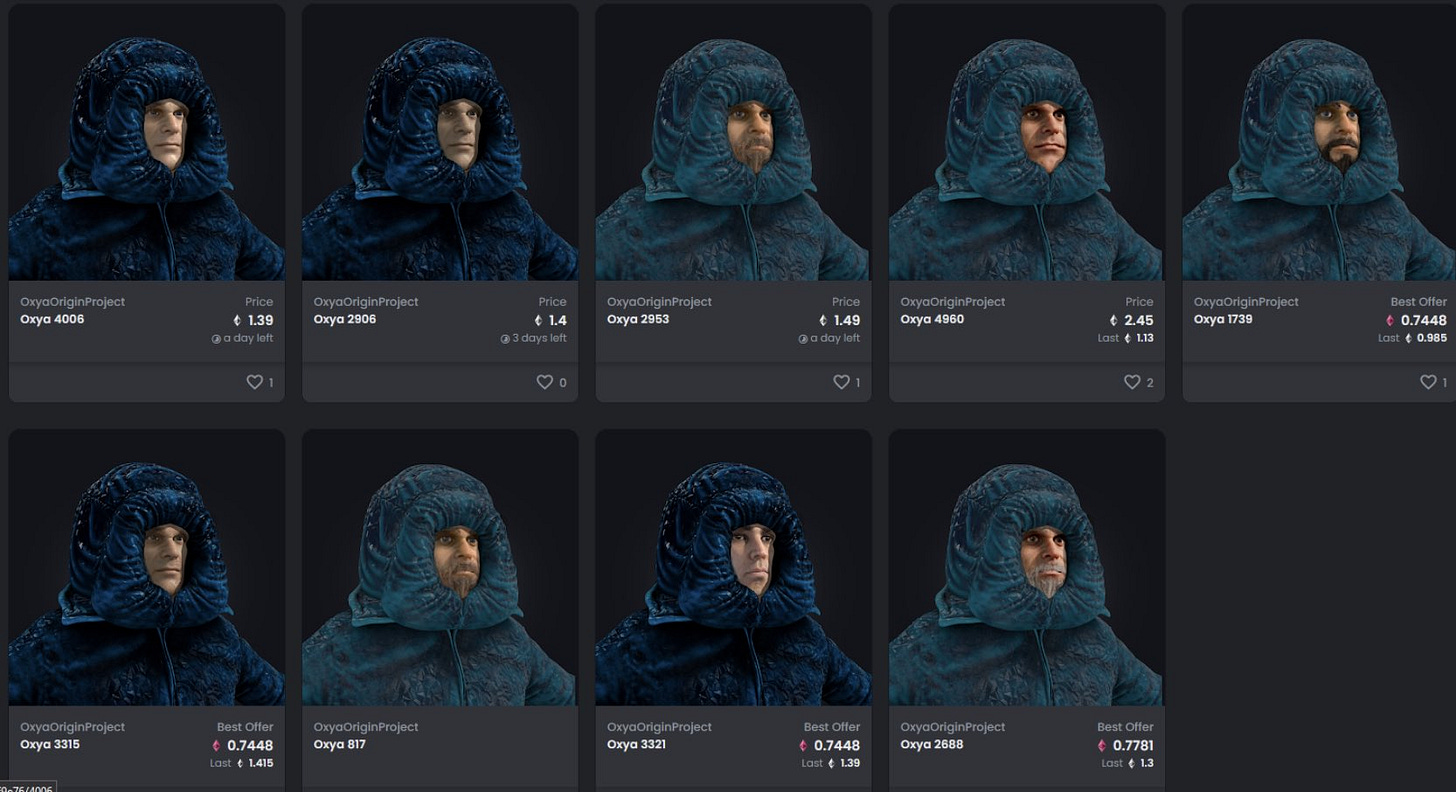

After pumping their Discord and Twitter full of bots tied with filling WL requirements via invite competitions the project has seen an expected quick pump. However, just like any artificially grown project, the price dipped significantly and this was made worse by the art shown in sneak peeks being extremely different to what was actually revealed. The art revealed was of poor quality and the price has lost over 1eth in value in just a few days and is expected to tumble further. The team are unlikely to deliver on any promises, so this project is definitely one to avoid investing in.

Similarly, to Oxya, C-01 pumped their Discord and Twitter full of bots and filled WL requirements via invite competitions. Again, a quick pump in floor price occured. However, expect similar price action to Oxya. The art reveal may be better on C-01 however it fundamentally stays the same. Artificial growth in this space will never, and has never, been sustainable. Thus, a further dip is to be expected both short and long term

Ethereum Price

After a significant dip to $3000, Ethereum has been consolidating in the $3000-3400 range.