WHAT WE CAN LEARN FROM THE NFT BULL MARKET🐂 + BENDAO IN TROUBLE

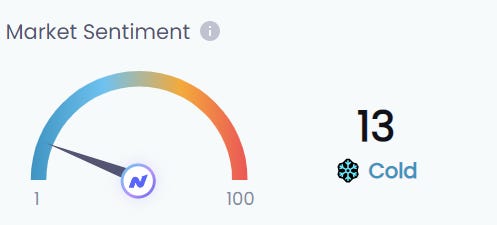

State of the Market ⚡

The UK’s weather isn’t the only thing that's cooling down right now, just check out the market sentiment?!? When we thought things could get any colder out here but it looks like the general market is feeling a little shakey, to say the least.

The NFT Blue-chip index has taken blows having trended down for the last 30 days with major NFT floors dropping. As for Volume…. Well, let’s not go there. We won’t labor the point here, things are rough. It’s that time in the market when your family is asking how the NFT collection you bought for them is doing and you are lying about the Floor price. We get the feeling and believe us when we say, we have been through some huge bear markets in crypto but we are all in this together.

What we will say is, try to remember we have witnessed a huge bull in NFTs that sparked off around March 2021, and right now we are feeling the sting. We have said it before and we will say it again, markets need to recover & consolidate in order to mature & grow. Although we wish it could be it can’t be UP ONLY season forever. Rather than a bear market, we like to call it a builder’s market, this is the time when narratives form and & the frameworks for new innovation are put in place.

On that note, here is a quick-fire checklist of things you can learn from the previous bull run and become a better NFT collecter in the future.

What we can learn from the NFT Bull run 🐂

If you are in profit take it - Unless you are in love with an NFT, or you have a super long-term conviction on a project, it's okay to take profit, in fact, its’ necessary to stay in the game. If anyone tries to call you a paper hander, tell them where to go. Profit is Profit, and Greed (waiting for a higher price for exit) is one of the human emotions that can ruin a portfolio. “Nobody ever lost money from the sidelines.”

NFT Scoop Greed Confession - I was once Airdropped on NFT that rose to the value of 1.75 ETH, I didn’t sell as that NFT gave me a whitelist for a project linked to that airdrop. Well, the project I was whitelisted for flopped, and the Airdropped NFT is now worth 0.03 ETH”.

It’s ok to sell at a loss - Maybe you are in need of liquidity or maybe you have just lost total conviction in a project. We have all been there, you want out of an NFT project but you are waiting for the Floor for that NFT to rise back above the price you bought it at. Guess what. It’s better to sell at 10 or 15% loss than it is an 80% loss. This plays a big part in risk mitigation, you should review your portfolio regularly in order to keep your risk at levels you are comfortable with.

FOMO can REK YOU - Over the course of the bull & the bear market, we at NFT scoop have APED hard into projects, this typically works if you are in at the right time with a planned exit or you have picked a project that many more multiples to be made. But get it wrong, you can end up being someone’s exit liquidity. Remember it’s your hard-earned ETH or cash you are spending. If you feel Fomo kicking in, breathe, walk away from the screen and think about it. If they really are the next ‘Bored Ape’ (Unlikely), the opportunity will be there tomorrow. Sure you may miss a few pumps but FOMO investing won’t make you a better investor or carry you to wealth.

NFT Scoop FOMO confession - “I once APED into a picture of a Palm tree for 4ETH ($12,500) at the time. I later had to sell it for 1ETH ($1500)

The market is always there - We love this phrase, and some don’t quite get it. But no position is still a position. By reading this newsletter you are taking active participation in the NFT space, by researching a project or a technical thread you are improving your knowledge of the market and industry. Just because you may be not holding an NFT right now, doesn’t mean you aren’t an NFT collector or investor. The right opportunity may not have come up, remember that the market is always there and ready for when you are.

It’s unlikely to be the next ‘Bored Ape’ - Yuga labs & the Bored Ape Yacht club have seen tremendous success & made some individuals extremely wealthy and we are by no means saying there isn’t room for other projects to see the same success, there are some incredible projects out there that have achieved BlueChip status, but this phrase is bounded around too much in the NFT space, and given the number of NFTs that launch, chances are that said ‘project’ wont be the next BAYC. Yuga labs had almost near first mover advantage, they innovated and captivated a community with incredible storytelling. The next project to have the same success won’t be your standard PFP, they will be doing something different, and perhaps in a category of NFTs we haven’t seen yet. BAYC has carved a path for others to follow, but those who can build on top of that, innovate & be truly unique will shine through.

Bet on Builders - Look around at the projects that hover around the top of the Opensea charts week on week & those that are still here, still relevant. They are all backed by amazing teams, that want to build, innovate & make a genuine impact to push the NFT industry forward. It’s like anything, a start-up needs a strong team, combined with consistency & vision to grow and succeed. Dig deep into projects and decide, will the team be here 12 months from now.

‘Most’ utility is a Ponzi

Utility is a narrative we hear time & time again for new projects launching. & others trying to stay relevant “Stake to earn our token”, “Lock up for this whitelist” Or “Hold for our next airdrop”. Now in order for a project to deliver future value via coins, whitelists, or airdrops, they need to have built a solid brand, IP, community, and culture before this takes place, there needs to be a demand for those future products. Just because X project throws in the word ‘Utility’ in a roadmap doesn’t mean it’s going to the moon or change the game. ‘Utility’ and especially ‘Web3’ utility (the promise of future NFTs, merch, etc') is only as valuable as the brand that is launching it, after all, who wants to wear the hoodie of a failed project?

Look out for projects that can execute & deliver utility that people take TRUE value from.

SNEAKS OF NATURE LAUNCH - EPISODE 3

Ahead of their mint on the 31st of August. The team behind Sneaks of Nature launch episode 3 in their series. The wider NFT community predicts the next wave of NFTs will be led by storytellers. What do you think of the episode?

Scoops of the Week 🍦

🍦BendDAO situation leads to potential mass liquidation of Blue-Chip NFTS

🍦Are Samsung about to take the biggest step yet?

🍦Another A-list Celebrity project looms

BendDAO situation leads to potential mass liquidation of Blue-Chip NFTS

To begin, it’s important we give you a bit of background information as to what BendDAO actually is - The platform is a peer-to-peer lending service that lets users borrow ETH against their NFTs. Users can usually take out a loan equal to 30% to 40% of the NFT collection’s floor price, or the minimum price to purchase one on the open market, with the NFT pledged as collateral.

All seems fairly straightforward…yup well here is where it gets interesting.

If the health factor of the algorithm hits < 1, your NFTs will get liquidated - see below

@BendDAO’s rules mean that liquidation does not occur right away, there is a 48hr protection policy where the borrower will have a 48-hour period to repay the loan otherwise a bidder can start bidding and after the auction ends the highest bidder can claim these NFTs.

Now for the issue - As we all know, the bear market has caused Floor prices to dip hard recently and as a result 45 of the 272 Bored Apes with BendDAO loans tied to them are now in the platform's danger zone and face liquidation.

On top of that BendDAO has run out of ETH with just 12.5 WETH left in the contract, therefore, people who lent money to others via BendDAO can't pull their money out leaving 15,000 ETH in limbo!

Investors are now at a standstill regarding what to do, borrowers must pay 100% interest on their borrowed ETH| and the debt against NFTs is continuing to rise.

In terms of the auction marketplace, BendDAO requires bids above the "debt" (Total borrowed amount) the borrower owes and above OpenSea floor. Even if you do wish to make a bid, you have to lock up ETH for 48 hours but with debt potentially being higher than the floor this creates a huge risk for investors.

If no bids are received then BendDAO really needs to consider what they do, sit on the NFTs, or amend terms to ensure investor funds are injected. At the end of the day, they desperately need ETH and fast.

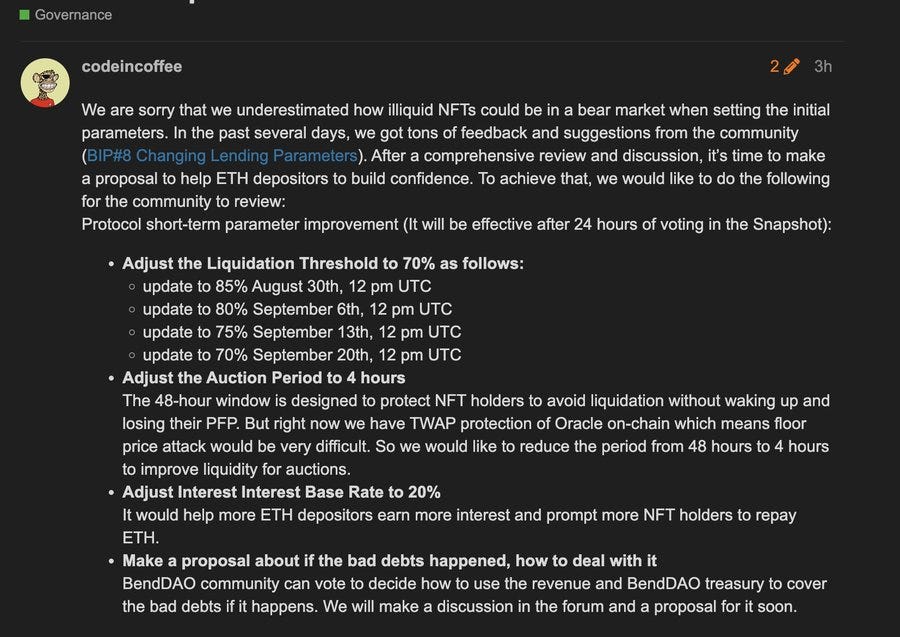

An emergency proposal has been set out by BendDAO which is as follows:

The knock-on effect as to the potential liquidation of so many Bored Ape’s led to Punks briefly overtaking Bored Ape in terms of floor price.

This is all the space is talking about right now…..whatever the outcome there will be a knock-on effect across the whole market. We watch from the sidelines intrigued and shall keep you updated on developments.

Are Samsung about to take the biggest step yet?

We don’t know too many details about this one yet as it is very fresh however it is a developing headline!

The tech giants who own 23% of the global smartphone market have set out plans to launch a Bitcoin and Crypto exchange in South Korea in 2023.

We have recently shared stories of the booming Asian market and with a powerhouse like Samsung looking to throw their weight in they could quickly assert market dominance in the continent due to the resources available.

Another A-list Celebrity project looms

A fairly relevant story given our REKT section last week where we highlighted the issues of Celebrity shilling and the failures of Celebrity based projects which Truth in Advertising stated that is an area rife with deception.

Well, the latest celebrity to up their intention of creating their own project is Miley Cyrus.

Miley Cyrus has filed metaverse and NFT-related trademarks which include Clothing, Energy drinks, sports gear, Virtual currency, and more.

As you’ll be aware we have always said DYOR, it’s vital in these times, Celebrities are more than likely to be able to lose more liquidity than the everyday person.

Despite some celeb projects flopping, it’s good to see active participation from global brands.

Scoop’s Weekly Winner 🏆

What do we love to see…. rising floors, a mega sale, a project looking to constantly develop and strive to grow.

This week’s winner is a no-brainer!

Pudgy Penguins come on down!

Let’s start with the floor, this time last week you could pick up an item for 2.2 ETH and following 2490 ETH of volume the floor now sits at an impressive 3.89 ETH

Now for the team development, the project has announced on their Twitter a new advisory board to take the project to the next level - check them out here!

And finally, the giant sale….. in the last hour (from the time of writing) item number 6873 has been purchased for a whopping 400 ETH $627,620.00)

This is a really exciting project and with the new team getting settled in, we are expecting some positive movement from our arctic friends!

Disclaimer

The NFT Scoop newsletter or podcast is not financial advice, it is provided for educational, informational, and entertainment purposes only.

NFT’s can be highly illiquid markets, causing sharp drops in prices due to changes in narratives and trends.

We would love to get to know you and maybe grab a sundae one day 🍨🍨