WTF IS 'R/R BAYC'.. It's Ripped a 10X in 2 days!

Disclaimer

The information contained in this NFT Scoop newsletter or podcast is not financial advice, it is provided for educational, informational, and entertainment purposes only.

The information contained in or provided from or through this website and podcast is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

NFT’s can be highly illiquid markets, causing sharp drops in prices due to changes in narratives and trends.

Scoops of the Week 🍦

Following Thirdyeoftruth Video that surfaced yesterday titled Bored Ape Nazi Club, the video was accompanied by the hashtag BURNBAYC.

A vocalist backing the video is Ryder Ripps, an artist famous for copying, minting, and selling unofficial versions of popular NFTs as a form of protest. He recently launched RRBAYC which is a clone of the BAYC and the 6.4K collection appears to have left in the traits which the original video noted above alleges are racist.

Thirdeyeoftruth has a close tie with Ripps given he has a financial stake in RR/BAYC. In return for the financial investment, Ripps gave him one of his NFTs for free on May 29th.

The floor of the project is moving up and fast, on the 19th June the floor sat an an average price of 0.12 ETH and is currently at the time of writing sitting at around 1ETH.

The hashtag BURNBAYC is trending on Twitter and the video is being shared widely throughout. Notable BAYC holders Steph Curry and Jimmy Fallon have recently changed their profile pictures from their Bored Apes so there is definitely more to come from story.

Immutable announces $500m Fund

This piece of news broke as the weekend began but was unfortunately after the publishing of our previous newsletter.

They took to their twitter to share details of the half a billion dollar fund.

The focus of the company will be to increase web3 and blockchain games adoption with the fund being divided into two parts – ventures and grants.

Christie's NFT Expert joins Punks

On Sunday 19th June, Noah Davis, Head of Christie's NFTS, revealed on his Twitter that in July he will be joining Yuga Labs as the leader for the CryptoPunks collection.

BAYC co-founder Garga said on Twitter that the new terms for Punks would be released in the coming weeks as these were frankly too significant to rush, and too impactful for the NFT community at large to risk developing them in silo.

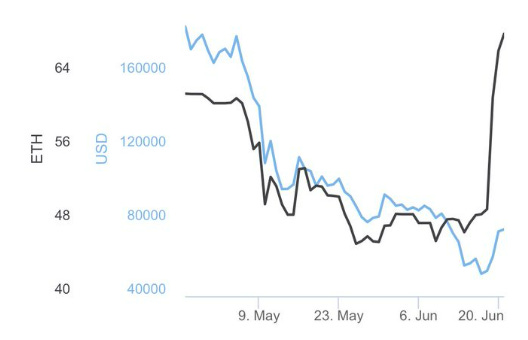

Investors seem to be lapping up the news, even though it may not be directly correlated to the news, the floor for the project has significantly raised. Prior to the weekend, items were being purchased in the 40-50ETH range and since the announcement sales are averaging between the 75-80ETH with a sale in the sum of 111ETH. As the below chart shows this has been a really positive few days for the project.

Astaria is a decentralized platform that allows holders of NFT’s to use their NFT’s as collateral in borrowing crypto against them to enable the ability of purchasing other NFTs. NFT’s are not all that can be purchased, crypto can be borrowed to trade and invest.

The company through a stream of investors was able to raise $8m to assist with the development of its platform which is due to launch in September this year. The company will be providing demonstrations this week at NFT NYC.

What is known is that in terms of assessing loan provisions, the company will be using an appraisal system whereby an appraiser will detail the characteristics of the NFT being used as collateral and will proceed to assess how much can be lent against the NFT, the length of the loan and the interest rate. There is a key element of human intervention in the process and there appears to be no automated system plans just yet.

We recently saw the troubles faced with lending facility firms with the recent breaking news surrounding Celsius. In case you missed it, Celsius is a Cryptocurrency lending firm that recently announced that they will pause withdrawals and transfers between accounts due to extreme market conditions.

Astaria’s plan to launch in September is a prudent move given the current state of today’s market being at its generally weakest.

The Chinese NFT Market Grows 5X!

Over the past few months, the Chinese NFT market is displaying strong growth. In February of this year, there were just 100 NFT platforms available to investors. At the time of writing this piece, that number has broken through 500 mark displaying a 5x market growth.

Despite the Government cracking down on NFT use, there is a siege mentality amongst investors to ensure they are not left behind on the global stage. It is worth noting that NFT’s are not illegal in China. However, most of the larger platforms are operated by major internet businesses to ensure that activity is kept away from the authorities.

To keep the authorities at bay, Alibaba associated entities such as Ant Group and Tencent advertise listed NFTs as “digital collectibles.” The NFT’s are also offered on private blockchains and are obtained via Chinese fiat currency.

There is no disputing the importance of the Chinese market in regard to global performance. It is worth remembering that in September 2021, the Government wanted to crack down on Crypto mining which resulted in a 50% decline in the BTC network hash rate. We attach a video explaining what the BTC hash rate is.

As one of the global leaders in finance, the Chinese do not want to be left behind with NFT’s and if they are to continue their incredible rate of growth, this may aid the recovery of the global market.

To kick off “Ape Fest”, which is what the Bored Ape Yacht Club are calling their events at NFT.NYC , they have started with a huge announcement on their Twitter of a collaboration with Rolling Stone.

The collaboration consists of two 1/1 NFTs (one BAYC and one MAYC) which go live for auction on 22nd June at 9am ET (13:00 GMT), and will be accompanied by a 4-hour sale for collectible art prints of each design. Sales will be in ApeCoin-only for the equivalent of $100, and open to the public.

BAYC is definitely kicking off Ape Fest with a bang!

We will make sure to bring you all exciting developments from NFT.NYC

Weekly Market Summary ✔

With ETH hitting the 3-figure region this week, we have seen the market continue to down-trend in a number of ways. In the following paragraphs, we will break down a number of factors impacting the market.

Crypto Value

Firstly, the crypto market was dealt a heavy blow this week. The price of Ethereum came down from the $1200 region down to a bottom of $888 over a couple of days. This created fear amongst investors. This downtrend was seen in other popular coins as Bitcoin came down from the $22k region to a bottom of around $17.5k and Solana from $35 to $27. Firstly, with crypto decreasing as did the value of NFTs to the region of 20-30% at the bottom. Despite this, BTC, ETH, and SOL have all but recovered to their prices before this week’s downtrend over the last two days. However, it is unlikely that these levels will hold for an extended period of time.

NFT Trading Volume

Secondly, we saw the lowest trading volume on Opensea in the last year over the past few days. During the peak of the bull market, Opensea’s daily volume peaked at almost $500m. Throughout the bull, we were averaging comfortably above $100-200m in volume per day. However, as of the last few days we have been averaging around $5m a day. This is a 20x drop-off and obviously reflects the state of the NFT market today. On June 15th Opensea saw $9m in daily traded volume, by June 17th this had dropped to just over $3m. Bullish moves for Crypto Punks which outperformed the volume of 1000s of projects on Opensea. At the time of writing this looks to be replicated again today, possibly due to the Head of Christes NFTs joining Punks.

Another volume indicator we can look at is the transactions completed per day on Opensea. Over the last 20 days, there has been a fall-off in transactions which has now bottomed out. Transactions at the back end of May and the beginning of June were around 200k per day. As of the last 3 days, this has fallen to around 15-25k per day. This suggests hesitant investors in the NFT market at the moment. However, it is worth noting that on the 12th of May transactions fell to the 30k region and within 10 days had returned to the 200k region. Thus, right now is probably not the best time to sell your NFTS!

The NFT Community

Thirdly, by examining buyers and sellers we can clearly define in what direction the NFT market is moving in. It is simple economics that when demand outweighs supply the price increases. However, since the beginning of June, in the NFT space, the supply has been outweighing the demand. This is something that we are yet to see highlighted. To string some examples together, during the bull market in January, some days we had 52k buyers to 46k sellers, other days we had 38k buyers to 32k sellers. This number varies but the number of buyers consistently stays above the number of sellers. This pushed us in a positive bullish direction as a whole even and what we are witnessing now is a healthy pullback across the NFT Space. Yesterday, there were 7000 sellers to around 5000 buyers.

New Mega MAYC Join the party

Subscribe to NFT Scoop!